Analysis: Dell Technologies, Inc. announces Q2 FY2026 financial results

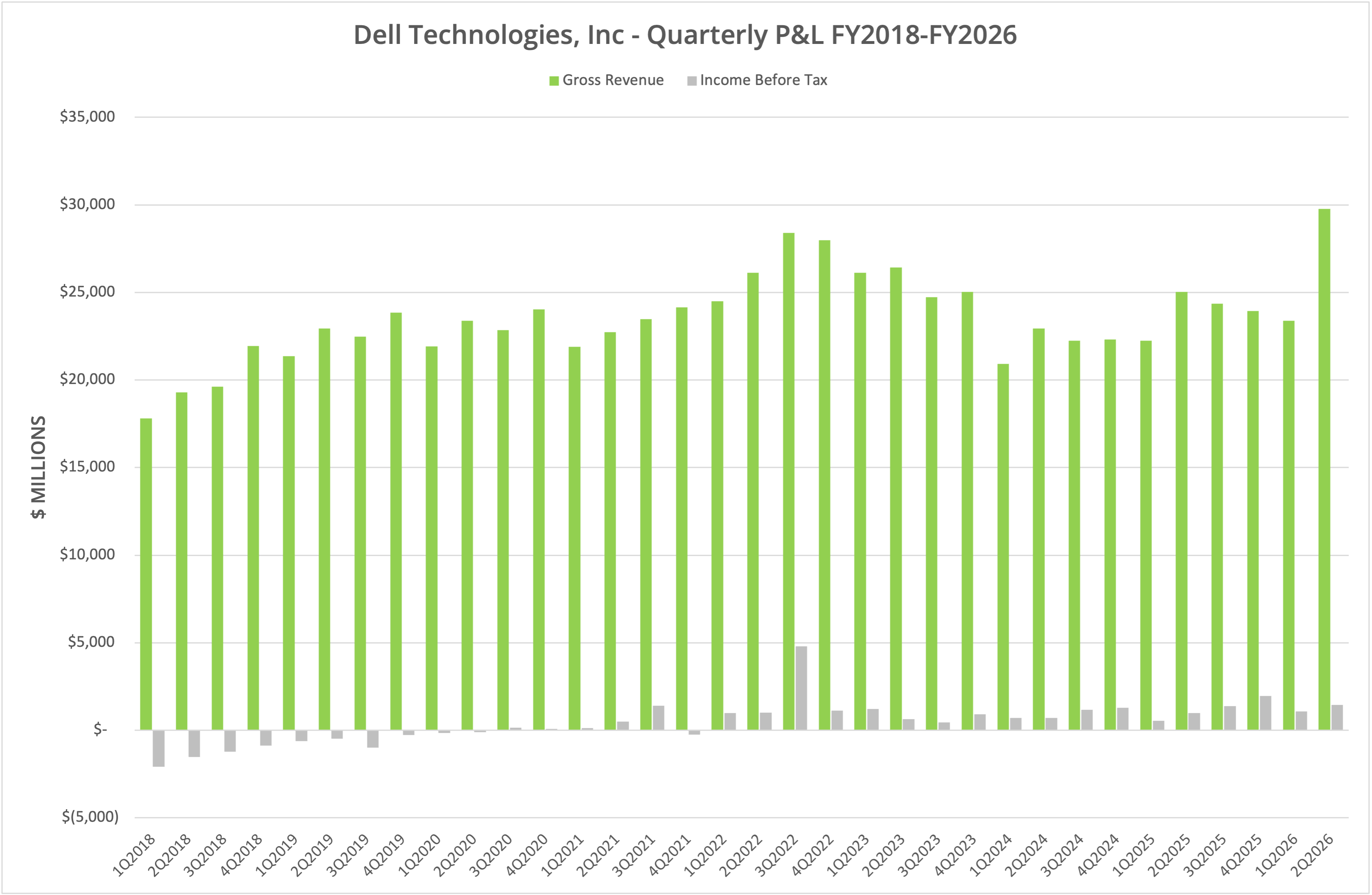

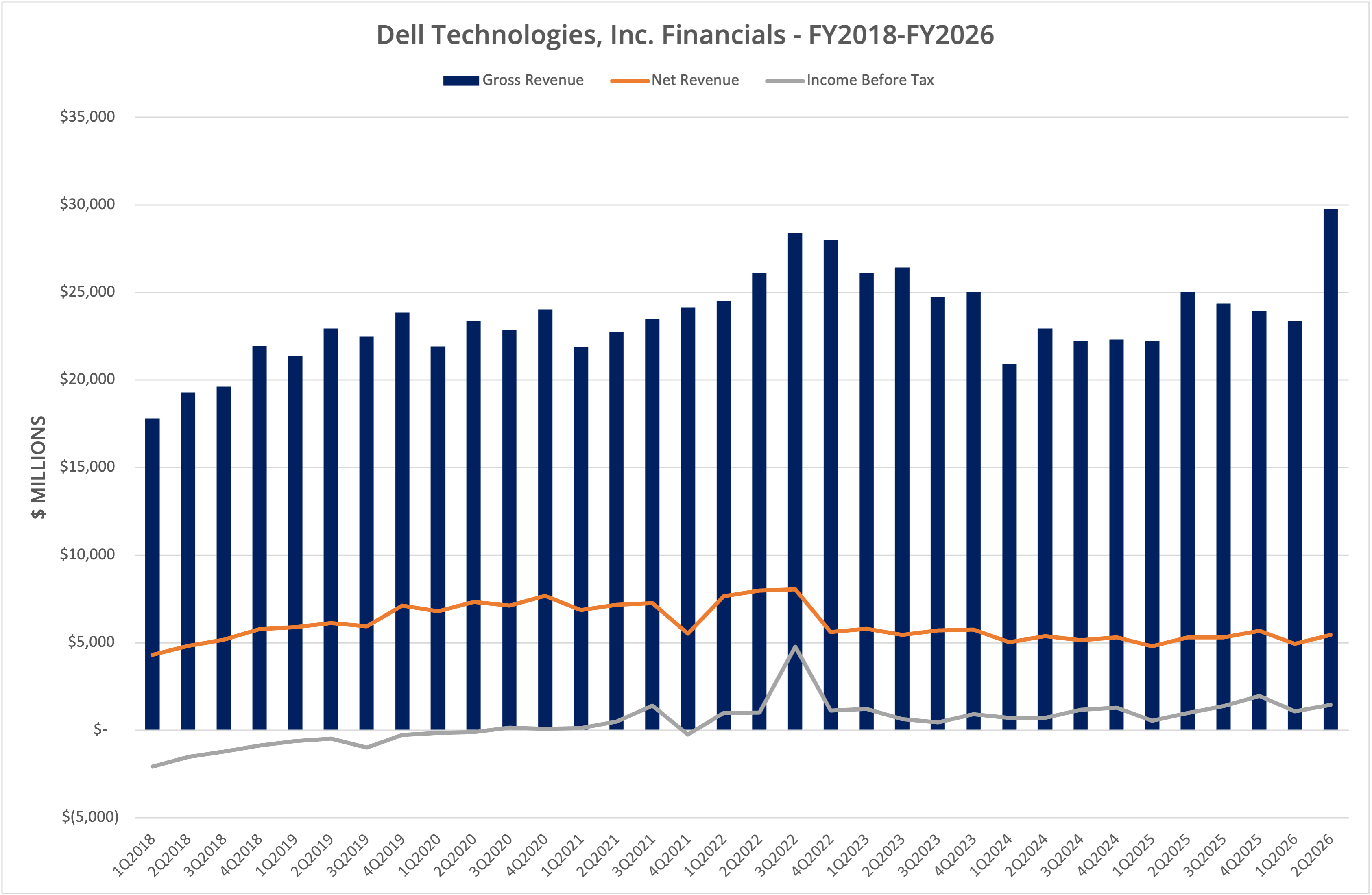

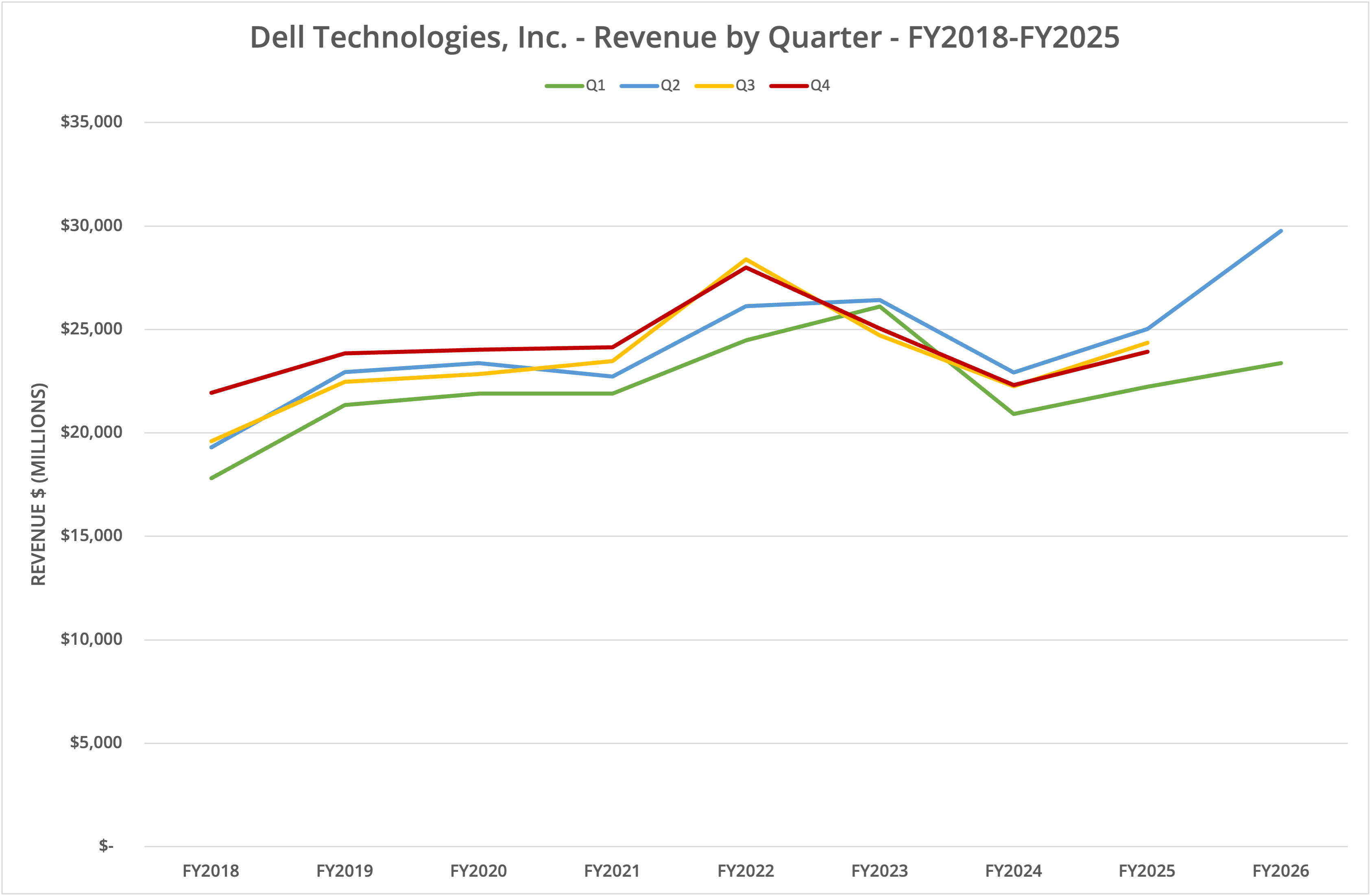

Dell Technologies, Inc. has announced financial results for the second quarter of FY2026 (ending 1st August 2025). Revenue rose 19.0% year-on-year to $29.8 billion for the quarter, a record for the company.

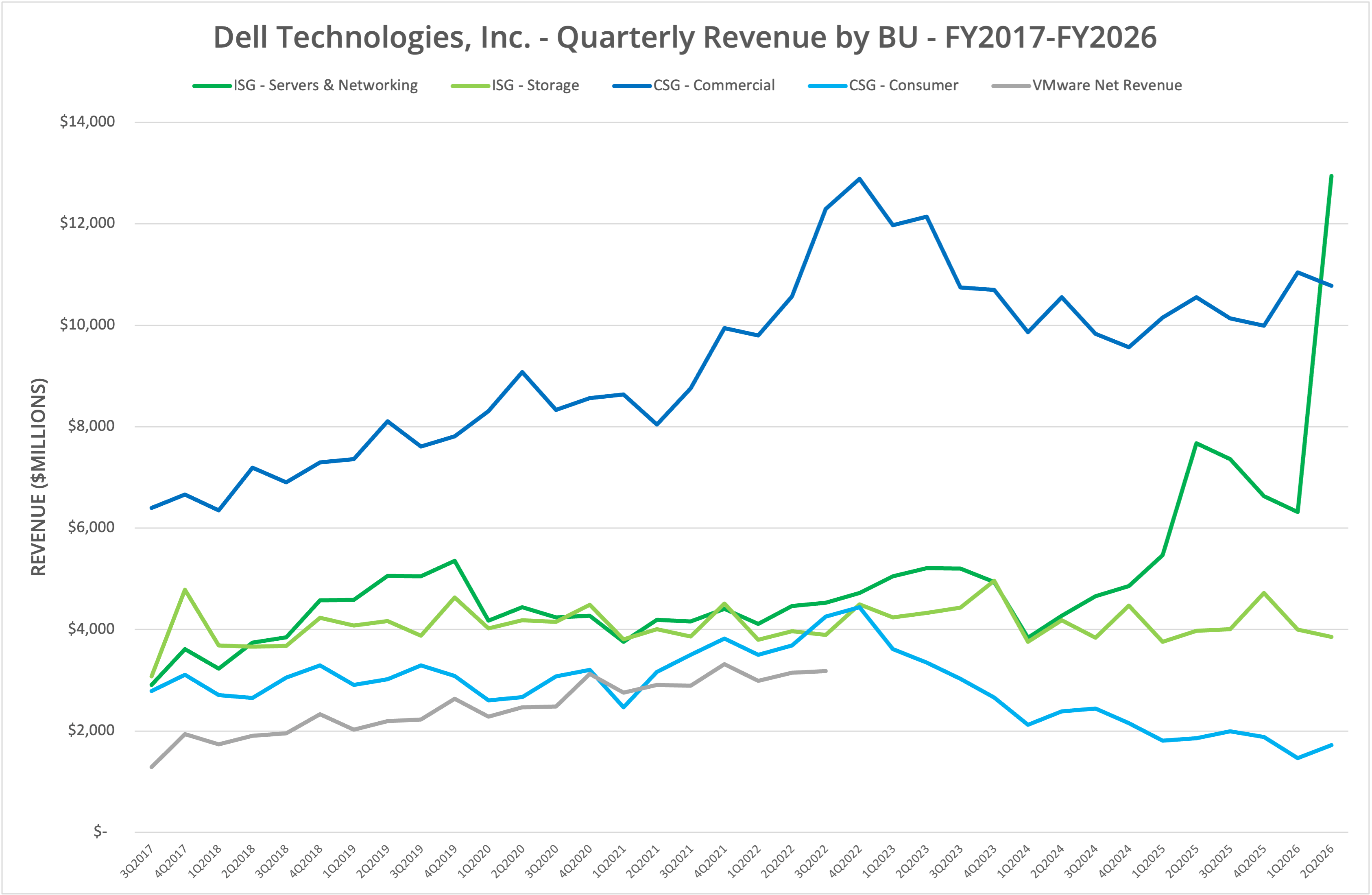

Dell Technologies, Inc. has announced financial results for the second quarter of FY2026 (ending 1st August 2025). Revenue rose 19.0% year-on-year to $29.8 billion for the quarter, a record for the company. The improvement was driven by a massive rise in server revenue year-on-year of 68.7%. However, other parts of the business appear to be languishing behind the drive to sell more GPU-based servers.

Background

Dell Technologies, Inc. declared financial results for Q2 FY2026, the period ending 1st August 2025, on 28th August 2025. Total revenue rose by 19.0% to $29.8 billion. Product sales (as compared to Services) now account for 80.4% of revenue.

We present the data in eight graphs, labelled Figure 1 to 8.

Box Shifting

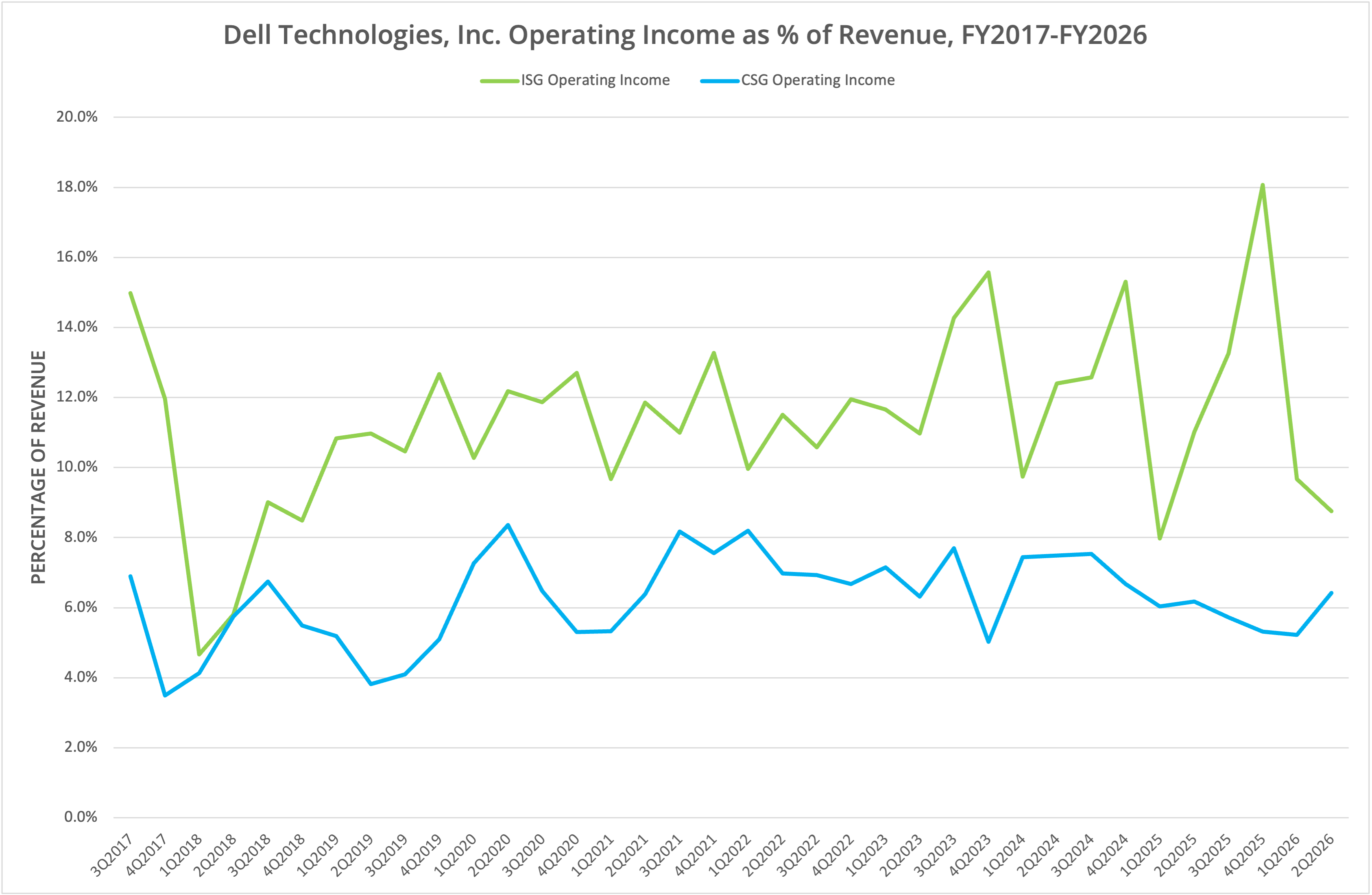

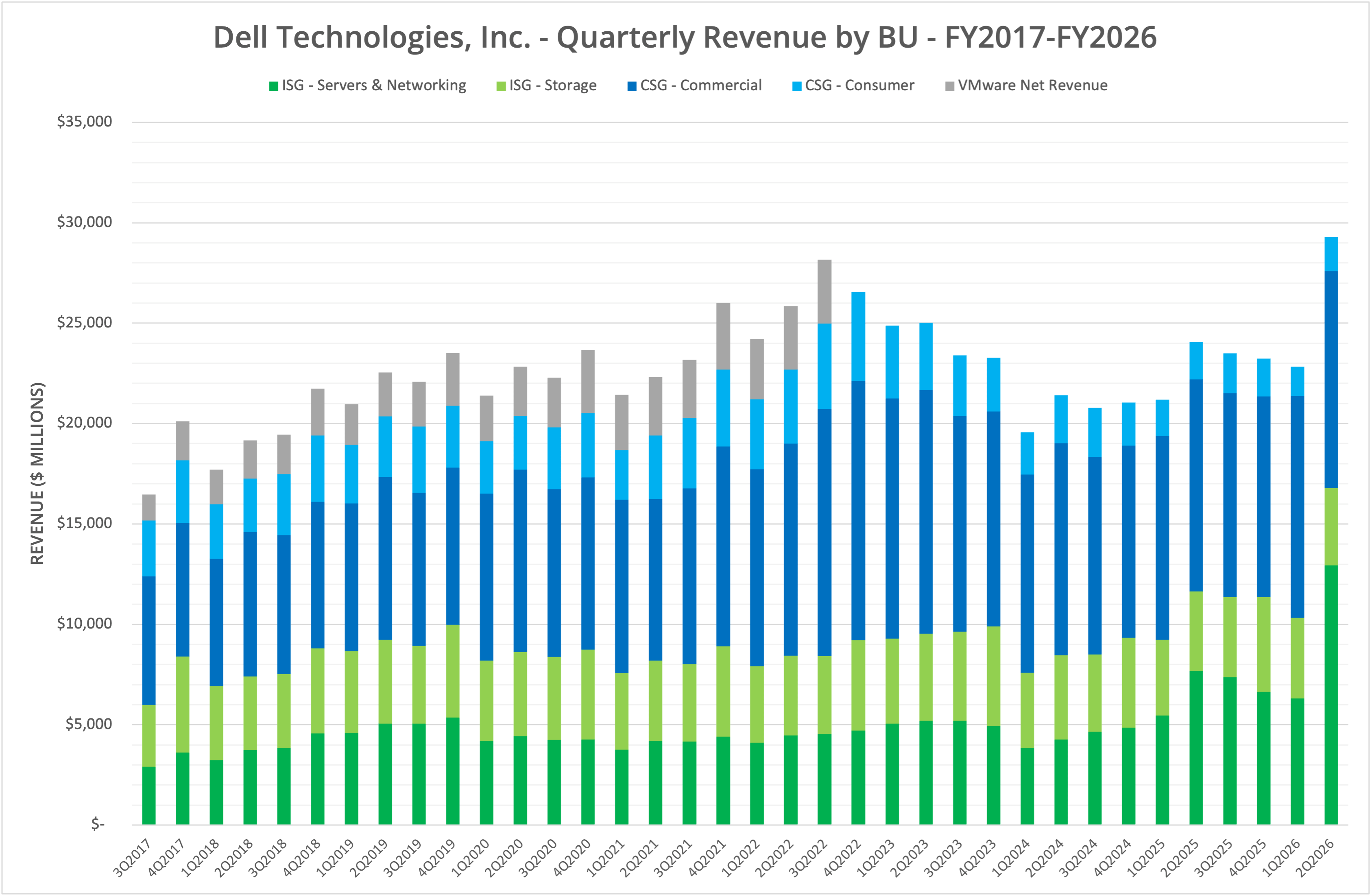

Figure 8 dramatically demonstrates the rise in server sales. We can see a spike upwards in the ISG – Servers & Networking segment revenue of 68.7%, year-on-year, to approximately $12.9 billion, or 43.5% of all revenue generated in the quarter.

There was a time when Dell made most of its revenue from PC sales. That is no longer the case in the AI-driven world. The CSG – Consumer segment declined another 7.3% year-on-year, while CSG – Commercial rose by only 2.1%. Elsewhere, ISG – Storage declined by 3.0%, year-on-year.

Dell is the classic box-shifting business, with Servers & Networking achieving only a 12.1% margin in the current quarter. In contrast, that segment has reached peaks of over 20% in the past.

Margin Impact

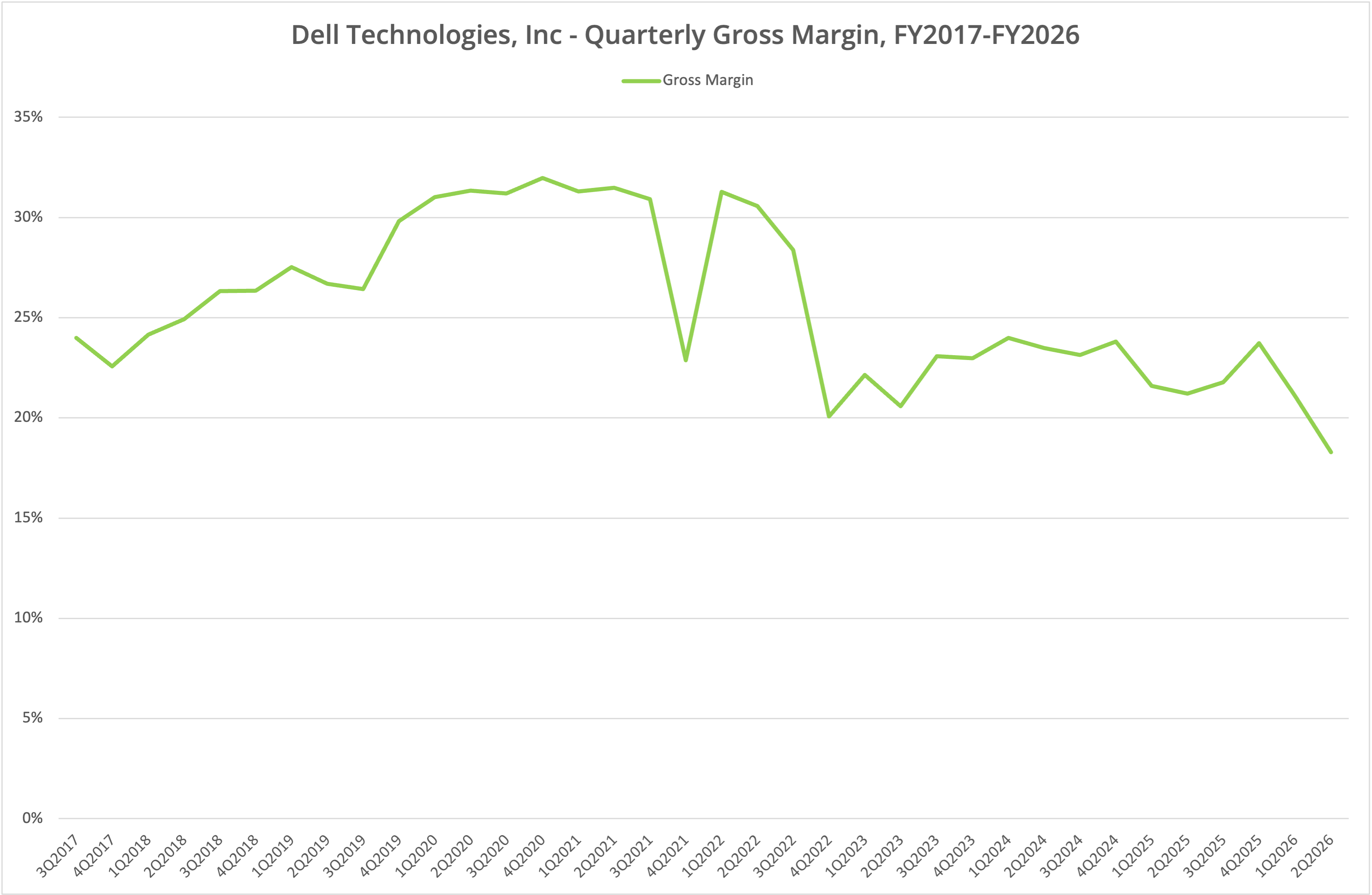

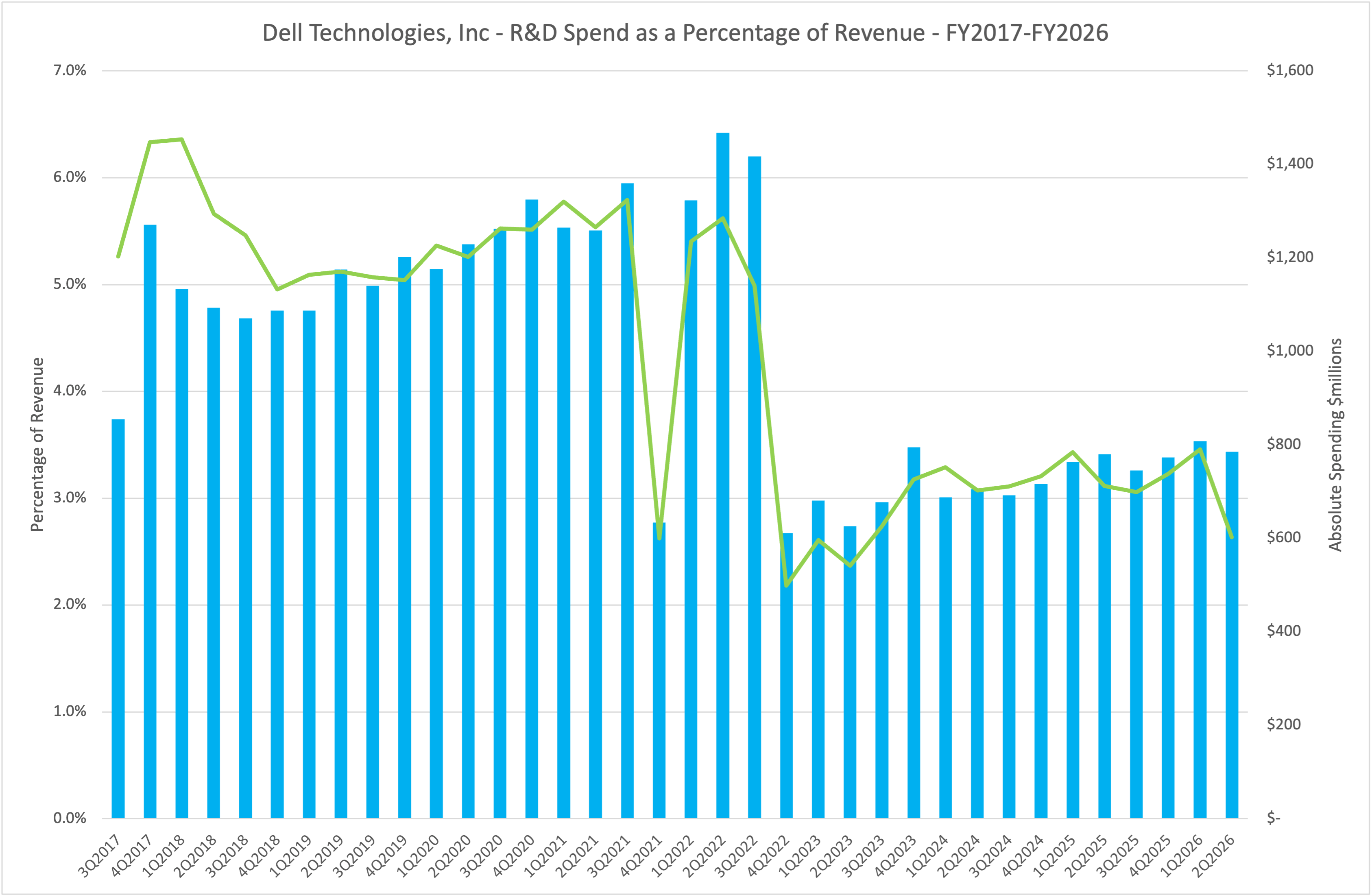

Should we care about the level of gross margin, when, as shown in Figure 4, the historical trend over the last three years has been 20-25%? Margin is used to fund sales, marketing, admin and research/development. As shown in Figure 6, Dell currently spends approximately 3% on R&D, whereas historically that figure was between 5% and 6%. We’ve shown absolute numbers too, to highlight that spending has declined in relative and absolute terms, not as a function of increased revenue.

Investment

In our analysis, we focus on Dell from a data storage perspective, so direct comparisons are difficult to make, but we can look at overall R&D spending as a percentage of revenue compared to Pure Storage (28% in Q1 FY2026) and NetApp, Inc. (16% in Q1 FY2026). Even if we assumed that all Dell R&D funded the storage business, that would translate to just 20% of ISG – Storage revenue, still below Pure Storage.

Purely in the storage business, we believe Dell Technologies is significantly underinvesting in research & development. The flagship PowerStore platform, for example, still uses generation 2 hardware-based Intel Cascade Lake processors first introduced in 2022. The last hardware update was the introduction of QLC NAND into one model of product in May 2024. This solution uses QLC drives of only 15.36TB capacity.

Elsewhere in the industry, Pure Storage has already delivered 150TB DFMs (effectively internally developed SSDs), with 300TB expected in 2026. NetApp supports 30.7TB drives in the higher-end solutions, with larger capacity drives on the horizon for Insight 2025.

Innovation

Of course, hardware capability is only one aspect of modern storage delivery. Customers want a cloud-like experience over the lifetime of their storage platforms deployed on-premises. Both Pure Storage and NetApp have better public cloud solutions than Dell. Both companies also offer a better experience than Dell for on-premises deployment and management.

The Architect’s View®

By virtue of its acquisition of EMC Corporation, Dell Technologies still holds the #1 place for storage revenue. Both HPE and IBM no longer itemise storage revenue data, but in comparison to Pure Storage or NetApp, these companies in the current quarter represent only 22% and 40% of Dell’s storage revenue, respectively.

That leading position enables Dell to be relatively complacent about recurring business with their customers. However, it is worth noting that since Dell acquired EMC, its storage business has flatlined at around $4 billion per quarter in revenue, excluding any changes for inflation.

We are not a business or investment company but are instead focused on technology. When we perform a detailed analysis of the features and functionality of PowerStore and other Dell storage solutions, we see offerings that lag well behind the competition.

However, data storage is a “sticky” business. Changing vendors involves data migrations, new processes and procedures and new standards for every aspect of the IT function. Businesses don’t change vendors lightly. Instead, what we are seeing is the gradual attrition of Dell’s storage business, as growth in the market goes elsewhere (to competitors and the public cloud).

In the long term, Dell Technologies may not care that this process occurs. After all, little will probably change in the next decade, by which time the EMC acquisition will have paid for itself. But, from the customer perspective, it is clear there are better products and solutions available from companies we’ve highlighted here – and many more.

At some point in the near future, the revenue from GPU-based servers will end. What happens then? The historical strategy of infrastructure vendors acquiring storage companies is arguably over. Dell (or HPE for that matter) are unlikely to buy another storage start-up to replace their existing technology. HPE has also just digested another networking company and sees greater gains there.

The post-AI boom could be difficult for Dell, as businesses look for efficiencies following the AI spending over-exuberance. We don’t believe Dell, or its customers are positioned to gain from this downturn, unless a significant change in strategy is adopted.

Post #536c. Copyright (c) 2025 Brookend Ltd. No reproduction in whole or part without permission. Dell Technologies is an Architecting IT Tracked Vendor.