Analysis: Pure Storage, Inc. announces Q2 FY2026 financial results

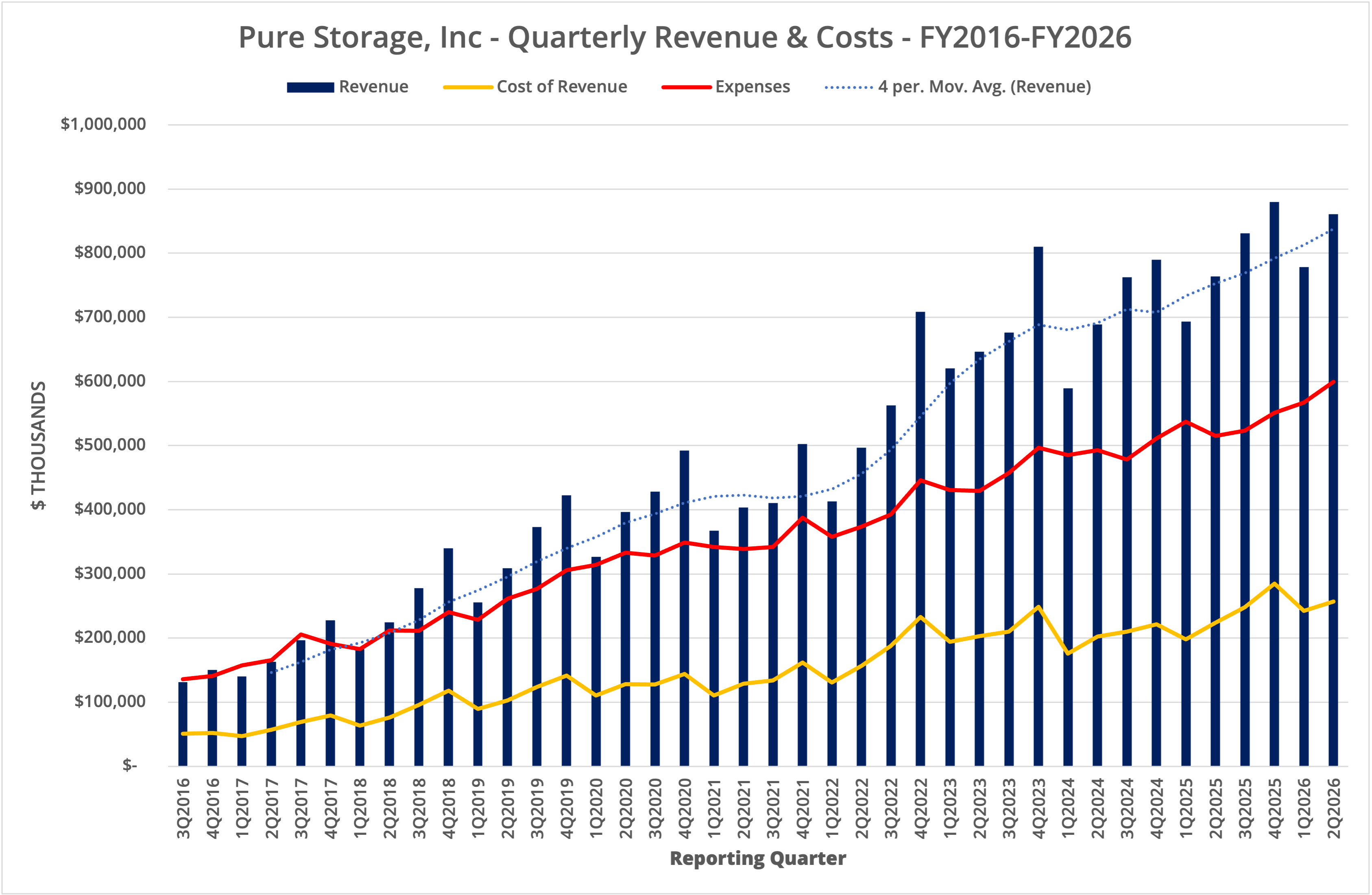

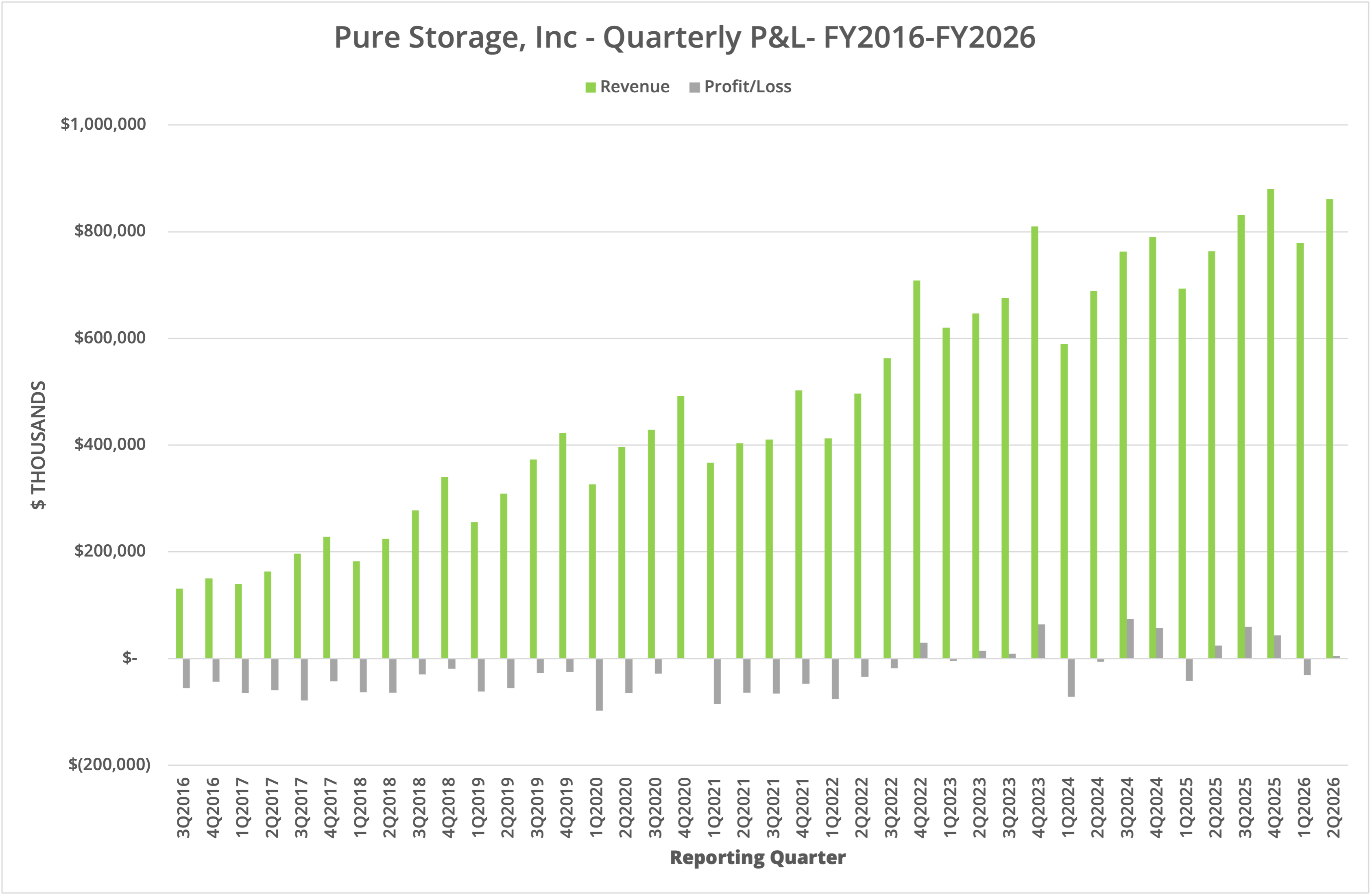

Pure Storage, Inc. has announced financial results for the second quarter of FY2026, ending on 3rd August 2025. Revenue increased 12.7% year-on-year to $861.0 million, with a gross margin of 70.2% and income of $50.6 million before tax.

Pure Storage, Inc. has announced financial results for the second quarter of FY2026, ending on 3rd August 2025. Revenue increased 12.7% year-on-year to $861.0 million, with a gross margin of 70.2% and income of $50.6 million before tax. Arguably, Pure Storage now leads the data storage industry, with the best approach to products and services.

Background

Pure Storage, Inc. declared financial results for the second quarter of FY2026 (ending 3rd August 2025) on 27th August 2025. Revenue for the quarter was $861.0 million, up 12.7% year-on-year and 10.6% sequentially. Gross margin was 70.2% with income before tax of $50.6 million.

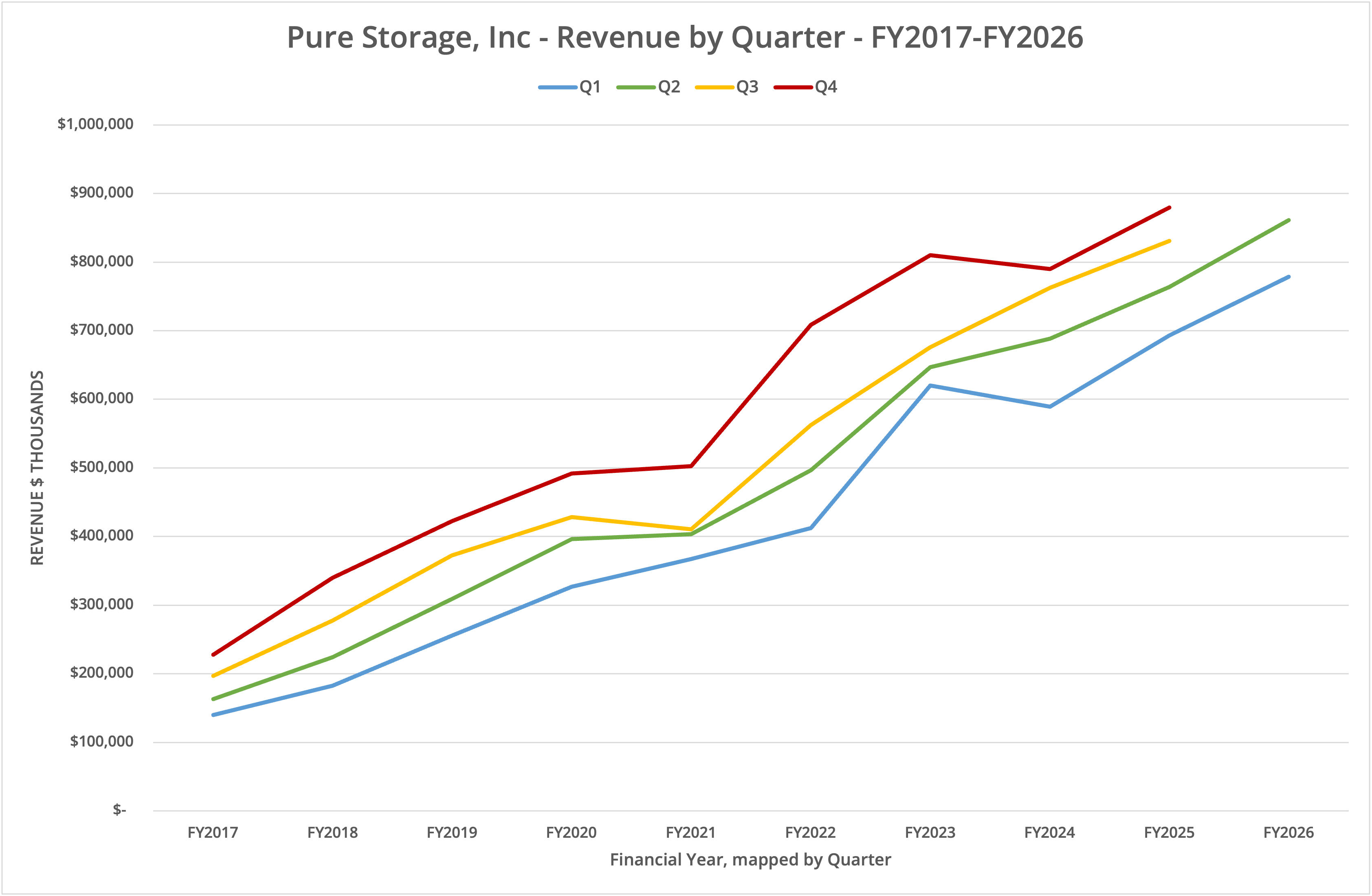

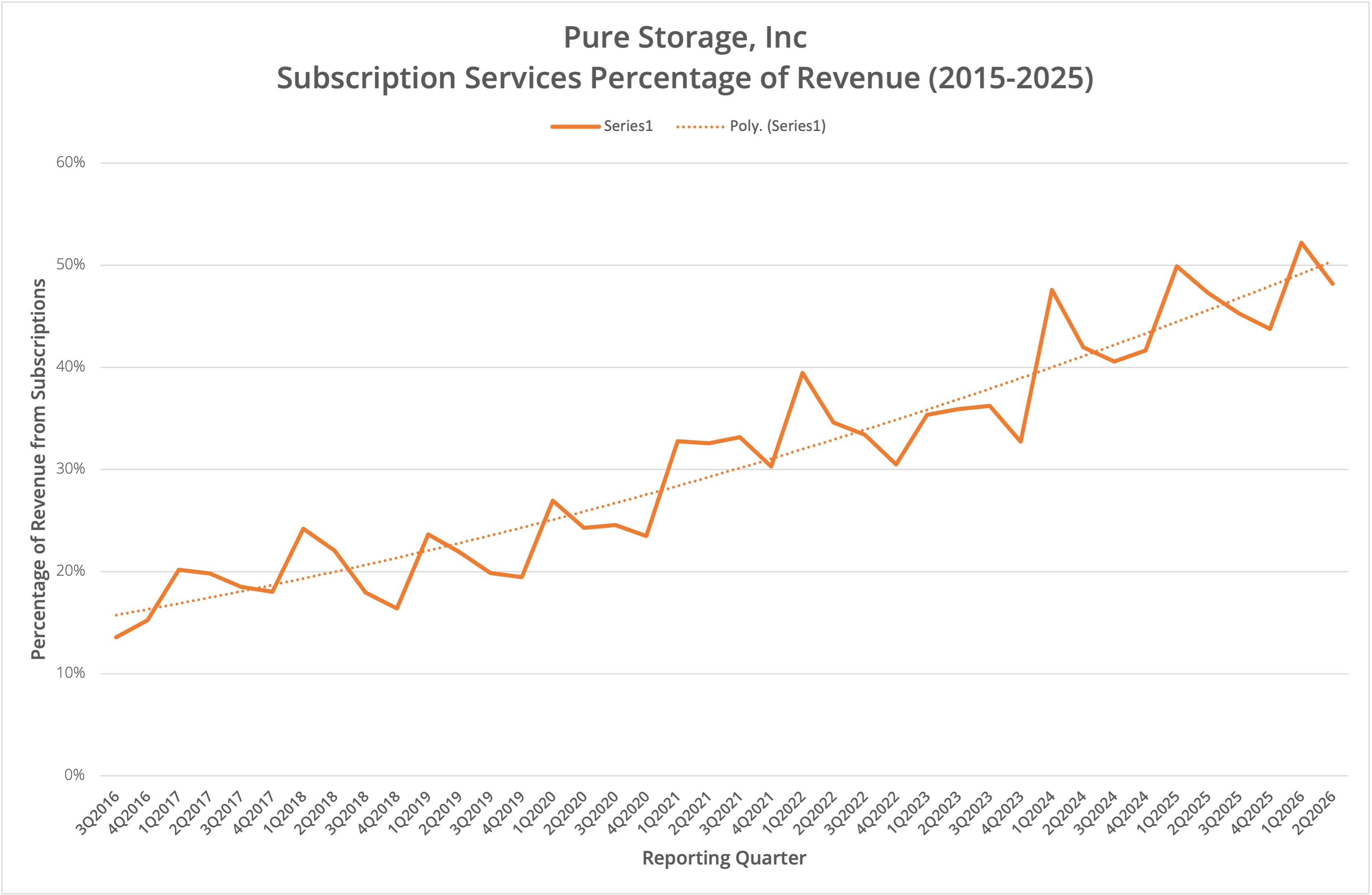

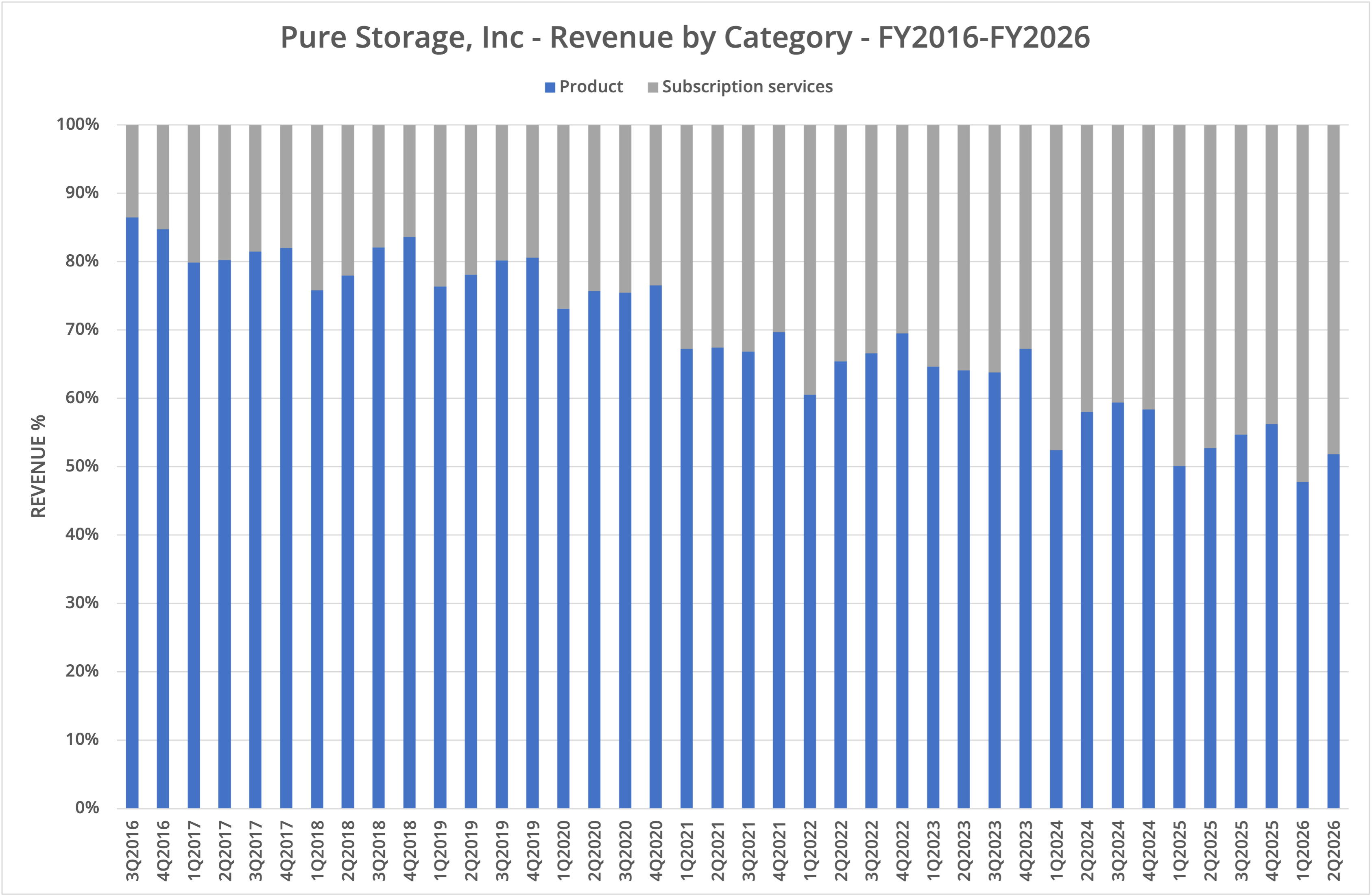

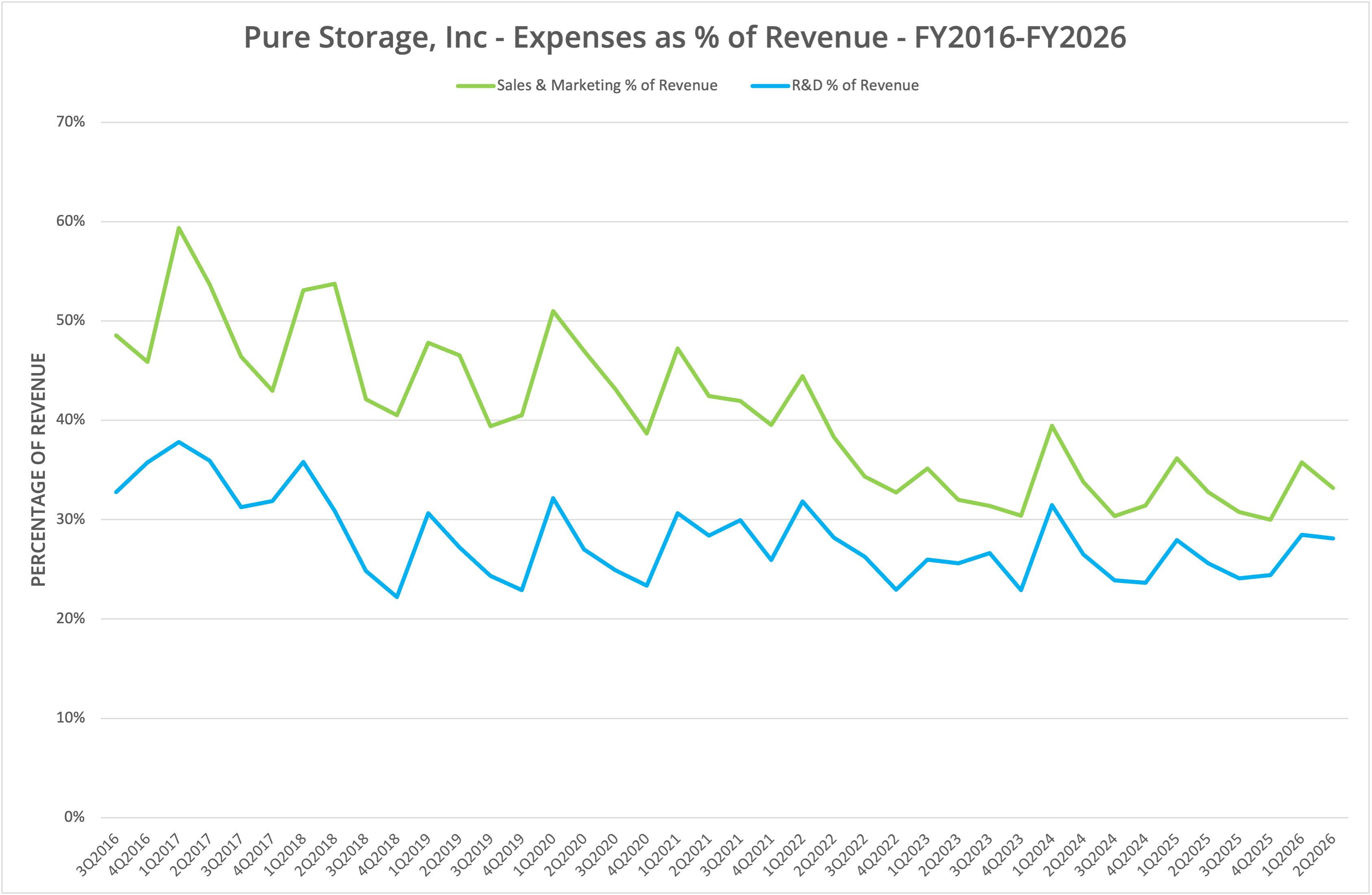

We present the data in six graphs, labelled Figures 1 to 6.

Leadership

Once again, Pure Storage presents another quarter of revenue growth, which Figure 3 shows is remarkably consistent. In June 2025, the company introduced a series of new hardware solutions and the concept of the Enterprise Data Cloud (our coverage here and here).

Enterprise Data Cloud

The Enterprise Data Cloud (EDC) concept is focused on pivoting businesses away from the tedious process of hardware asset management and instead concentrating on the requirements of applications and the business. The idea is an evolution of a multi-year process to automate manual tasks, provide deeper telemetry and simplify hardware to the extent that the customer outsources much of the legacy storage management tasks to the vendor.

Why is this important?

- Scale – the customer can deploy more storage capacity without a direct increase in overheads (people, process, refresh cycles, etc). Data storage capacity grows at a rate much higher than could be sustained if support staff followed a similar growth trend.

- Cost – the storage industry typically sees around 5% cost erosion per quarter, simply because media costs decline over time, while customers demand improved pricing to cope with growth. Reducing costs can’t be achieved without a plan for larger, more efficient storage solutions; a process that Pure Storage has arguably pioneered with DirectFlash modules and a range of configuration options.

- Flexibility – businesses want 24/7 operations, minimal interruptions for hardware refresh or data rebalancing and infrastructure that caters for changing workloads. Flexibility becomes agility that removes the friction from daily operational tasks (like boosting performance or adding capacity).

The Architect’s View®

If all of the above sounds like a sales pitch or marketing story, then that’s because Pure Storage is possibly the only vendor on the market today delivering on all strategies in equal measure. The evidence is there to be seen in revenue growth, which remains constant and has done so for many years.

However, this doesn’t mean the growth cycle can go on forever. Undoubtedly, Pure Storage is claiming market share from competing vendors, which is clear from the relatively flat income of vendors like Dell Technologies and the withdrawal of specific storage segment reporting by IBM and HPE. But there are challenges in the public cloud and on-premises from software-defined storage solutions such as Weka and VAST Data.

We believe Pure Storage can sustain growth for some time to come, but will inevitably need to expand further in other markets. We’ve highlighted before that we think this should be further into the public cloud and with a greater focus on data.

This direction is not the way the company is planning to move. Within the next five years, the intention is clearly to gain access to hyperscale platforms, such as the deal with Meta (see here).

While a deal with Meta and other hyperscale clients is definitely appealing, the challenge for Pure Storage is to understand how this business model develops in the long term. Cloud vendors have a habit of building their own IP and/or gaining it through acquisition (see this post).

Already, we have seen the processor market as a good example of this trend. Hyperscale platforms started with generic x86 processors, then moved into custom models. From there, they adopted more efficient Arm designs. It’s only a small step to imagine a vendor such as Meta or AWS building RISC-V solutions in much the same way they have with GPUs.

So how could storage evolve? Currently, the critical IP for Pure Storage is built into hardware designs and Purity. If hyper-scalers decide to acquire a controller vendor, then self-built storage could become a reality.

Of course, there’s a massive learning curve for any organisation to build what Pure Storage has created over the last sixteen years. Hyper-scalers may decide that leasing technology is preferable to acquisition or self-build. In that scenario, Pure Storage is a winner.

The current strategy is an interesting one, which we believe is currently tilted towards success. However, we remain vigilant for signs that this position could change if the cost savings that can be achieved by self-build storage become too much to resist.

Copyright (c) 2007-2025 – Post #dcc2 – Brookend Limited, first published on https://www.architecting.it/blog, do not reproduce without permission. Pure Storage is a Tracked Vendor for data storage solutions.